ESG & Sustainability

ESG - an abbreviation that has been putting pressure on players in the real estate industry since at least last year. The term was coined in 2006 and stands for a more holistic approach than Corporate Social Responsibility. The "E" for Environmental adds aspects such as climate, resource scarcity, water and biodiversity to the "S" for Social (including employees, safety, health) and the "G" for Governance (including corporate management and culture).

ESG was not yet a defined term, and there were no Germany- or Europe-wide standards. But the Sustainable Finance Action Plan and the related taxonomy and disclosure regulation from the European Union (EU) contain binding criteria and classifications for companies and financial market players for the first time - although not yet comprehensively for all aspects of ESG.

The ambition and pace of turning the EU's economy "green" are ambitious, as the ultimate goal is climate neutrality by 2050, with an important milestone agreed to reduce emissions by at least 55 percent by 2030 compared to 1990 levels. With the amendment to the Climate Protection Act in August 2021, Germany is to become climate neutral as early as 2045.

To achieve these climate and sustainability targets, the participation of all sectors of the economy in this transformation process is necessary. The real estate industry in particular is under enormous pressure to change, as real estate is responsible for almost 40 percent of global greenhouse gas emissions. In addition, investors, buyers and clients are increasingly demanding sustainably developed, ESG-compliant real estate projects.

So the topic of "sustainability" has arrived in the real estate industry and all players are expected to act in an ESG-compliant manner. But what does this mean in practice?

Alpha IC GmbH, one of the leading consulting firms for real estate management, is currently seeing that the market is under pressure to change ad irritated by the range of demands. Against this background, this eight-part blog series is about approaches and concepts to questions and needs of the different actors and developments in this transformation process.

Part 2: Perspectives and needs of stakeholders - ESG in real estate practice

In the second part of our ESG series, we would like to discuss the different perspectives on the topic. Here, the word "per-s-pek-ti-ve" can be interpreted as point of view as well as a development possibility. In this publication we show that both aspects are often interdependent.

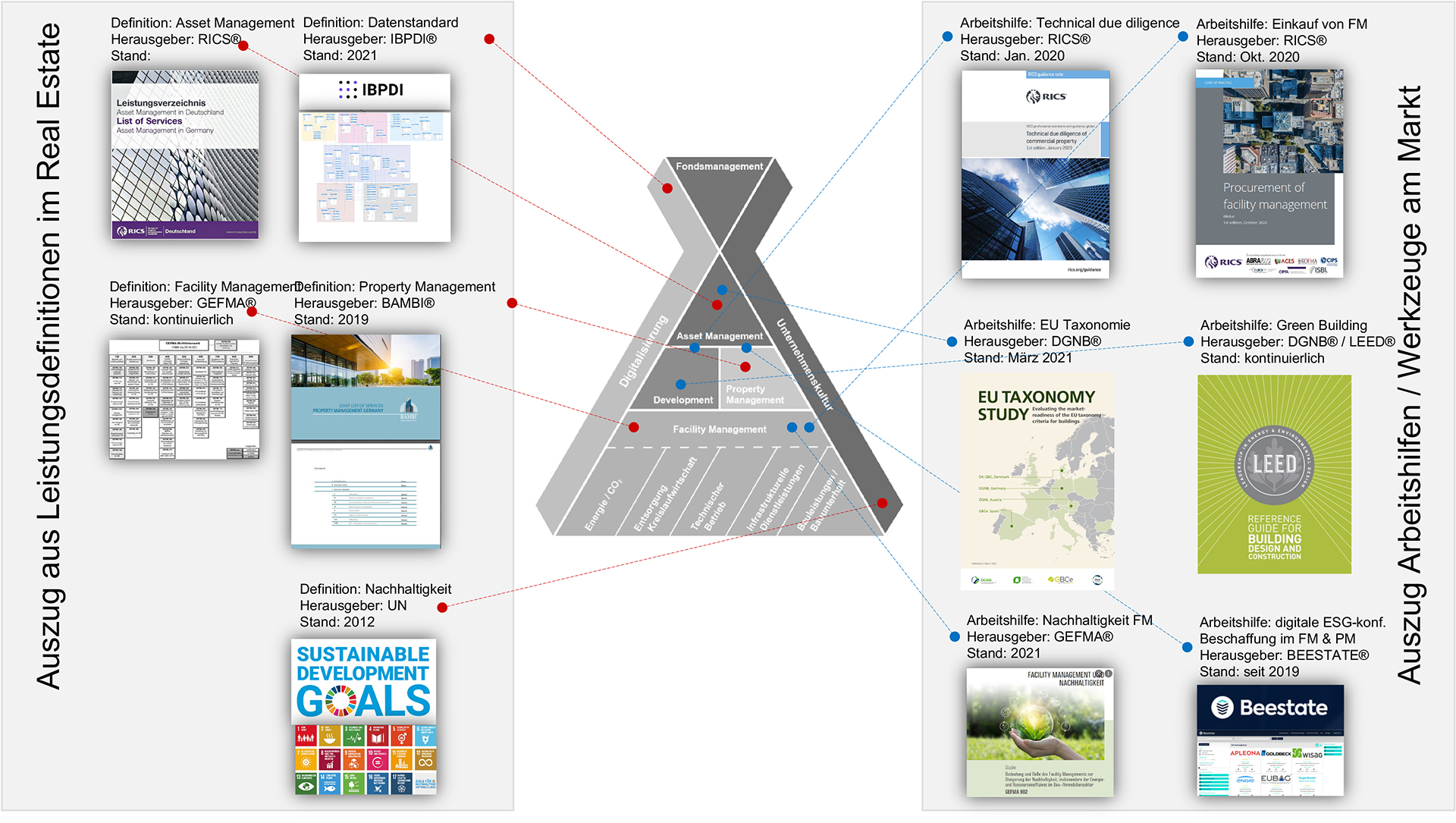

Based on our further development of the classic relationship pyramid in real estate management, which was influenced by the Gesellschaft für Immobilienwirtschaftliche Forschung (Society for Real Estate Research), we have illustrated the ESG challenge in a graphic. We have placed fund management as a representative of the investment level. Portfolio and asset management have been combined under asset management. These represent the classic property management for the portfolio, or integrate the development into their real estate portfolio (new construction and refurbishment). Both project developers and asset and property managers have to deal with operational facility management. This includes operational services in the property in a wide variety of forms; see Figure 1.

Figure

1: An interpretation of the real estate pyramid

The consideration of ESG introduces more activities in the classic pyramid in the various areas from the conception of sustainable real estate investment products at the fund level to the implementation of ESG goals at the operational level.

Many of the leading figures in real estate management are only now realizing that ESG concerns everyone. We have to realize that transformation in market practice is very difficult and is only being pursued tentatively.

In acquisition, questions such as "Is the property to be purchased ESG-compliant?" must now be answered. Many find it difficult to define ESG compliance for themselves and even more so to formulate their strategic orientation accordingly. After all, "governance" also includes one's own organization ;-)

ESG is a holistic challenge for all players, is how Prof. Dr. Jonas Hahn, Professor of Real Estate Management at the Frankfurt University of Applied Sciences, summarizes the current situation:

"The pressure from investors to act conscientiously in addition to generating returns is great. And so in the future, despite all the regulation, it will be about more than rhetoric. It is about the awareness in all management disciplines that with a property we not only acquire a building, not only rental contracts and cash flow, but also negative environmental impacts. It is about the willingness to minimize these forever, if possible, in order to maintain marketability. It's about a mindset among decision-makers to invest in reports, in their own organization, and in environmental performance in equal measure. Many players are on the right track, but it takes a lot of effort. This can be helped by a high-quality database from which the right conclusions can be drawn. Ultimately, data will become a new raw material for the real estate industry."

In most cases, there is a thematic break in the substance of the relationship pyramid shown above. This is often due to the following issues:

- Strategic alignment to sustainability (ESG) not clearly articulated.

- Lack of translation/transformation of goals for the next level down.

- Establishment of a sustainability officer or ESG officer without decision-making authority.

- Lack of understanding that ESG should be considered hand in hand with corporate culture and digitalization.

- Side-stepping the fact that this is a change process and must therefore be accompanied and consolidated by management in the organization.

- No adaptation of supplier and service provider relationships, PM and FM are also changing.

- Realization of individual projects in the delimited areas such as data offensives without consistency and holistic strategic approach.

Over the years, the roles and thus the service offerings in the real estate have become consolidated. As can be seen in Figure 2, many organizations have addressed their standardization and thus the improvement of collaboration. We are currently experiencing a serious reorganization and modification of these fields because ESG is everyone's business. And for this reason, additional tasks and thus also complementary activities will have to be performed. This is not easy for many players. Technical PM or operational FM deserves particular mention here. These areas are suffering severely from the shortage of skilled workers and, at the same time, having to meet ever-increasing demands.

Figure 2: Change in service content and standards (download at the end of the article).

Using the service "waste disposal" as

an example, one can see the change in service description that ESG brings

about. In addition, there are ESG goals, such as the reduction of waste

generation by influencing the user or the requirement for transparency of the

actual waste consumption by balancing the waste fractions.

Figure 3: ESG additional requirements in the ‘waste disposal’.

It becomes clear that it will be necessary to establish new roles: that of an ESG manager and an ESG coordinator.

The ESG manager ensures the integration of the topic in the individual areas. He/she is responsible for the implementation of the developed strategy (ESG goals) and the requirements on portfolio and object level and ensures consistency in all areas. He/she continuously checks if the implementation of the requirements by PM, Development and/or FM is done and compliant with the targets.

The larger the organization as well as the portfolio, the more it can make sense to establish an overall ESG coordinator. He/she then has the one essential task of transforming the ESG topic and thus translating and coordinating it into PM and FM providers’ performance specifications and activities.

Each of the providers has to provide an ESG coordinator. This person has the task of anchoring the cross-cutting issues in the company processes and ensuring that the requirements are met operationally. He/she is in contact with the energy, environmental and occupational health and safety officers in his/her own organization.

Assigning roles can be handled very individually in practice. The position of an ESG platform, which organizes and provides the necessary data and reports it upwards to asset management, can also be determined according to interests; see Figure 4.

Figure 4: New ESG roles in the REM

It can therefore be seen that a great deal needs to be done, from the organizational structure to the process organization and supplier relationships, to really anchor the topic of ESG and make it concretely implementable.

Jan von Mallinckrodt, Head of Sustainability at Union Invest Real Estate GmbH, sees that the players in the real estate industry are in a necessary and prolonged process of change:

"Buildings are sleeping climate giants, accounting for around 40% of global CO2 emissions. We must live up to our responsibility and offer great potential for a positive contribution to climate and society with the transformation of real estate in our funds. Also as an established asset manager, with a history of over 15 years in sustainability management, it is our daily task to make sure decision makers and stakeholders understand that sustainability is not marketing or a trend but affects all parts of the real estate value chain. The necessary transformation to climate neutrality cannot be achieved overnight, but is a process that involves all stakeholders, demands equal attention and requires capital."

Currently, we are faced with the challenge that everyone sees the topic exclusively from their own perspective, there is a lot of ignorance on all sides and, moreover, the change process is avoided. We would like to motivate you to take up the challenge, gladly together with Alpha IC GmbH.

In the next part of our blog series, we will look at the specific issues and perspectives for development in the ESG transformation process: What is ESG-compliant project development? Which certification is the right choice for my needs?

Future posts in the blog series: ESG in Real Estate Practice

Part 3: Challenges for Development

Part 4: TDD and ESG compliance

Part 5: Digitization needs for evidence delivery

Part 6:: Roadmap for a new corporate culture

Part 7: Meaningful rating versus greenwashing

Part 8: Whitepaper: ESG in Real Estate Practice: Plea for a Holistic Approach.

If you would like to read the first part of the series, please click on the link:

Part 1: ESG in Real Estate Practice - Perspectives and Approaches: Status Quo

Your contact persons at Alpha IC:

Barbara Bestmann, Consultant Alpha IC

Tel. +49 151 422294 - 54 ∙ b.bestmann@alpha-ic.com

- Green Building & ESG Consulting

- Strategy & Organisation

Sebastian

Hölzlein,

Geschäftsführer Alpha IC

Tel. +49 951 917 683 - 30 ∙ s.hoelzlein@alpha-ic.com

- Strategy & Organisation

- Sustainability

consultancy