"ESG - the big change in the real estate industry" is the title of a study by the auditing company PWC (PriceWaterhouseCoopers). Indeed, ESG is on everyone's lips, although the term was already coined in 2006 and stands for a more holistic approach than corporate social responsibility. The "E", for environmental, adds the aspects of climate, resource scarcity, water and biodiversity to the "S" for social and the "G" for governance.

It was not until 2015 with the implementation of the Sustainable Development Goals of the United Nations and 2016 with the signing of the Paris Climate Agreement that ESG moved into focus in the policy and the financial worlds as a standard for sustainable financial investments. To support the goal of keeping global warming well below 2°C, the European Commission published the first "Sustainable Finance" action plan for financing sustainable growth in March 2018. This includes a series of regulations for companies and financial market participants on more sustainable management and transparent disclosure of sustainability risks.

With the presentation of the "European Green Deal" in December 2019 and a second action plan, the European Commission has once again increased emphasis on climate protection and sustainability. The declared goal is to reduce net emissions of greenhouse gases in the European Union (EU) to zero. This would make Europe the first climate-neutral continent. As an important milestone, it was agreed to reduce emissions by at least 55 percent by 2030 compared to 1990 levels. With the amendment of the Climate Protection Act in August 2021, Germany is to become climate neutral as early as 2045. To achieve these climate and sustainability goals, the participation of all sectors of the economy in this transformation process is necessary.

In this process, the real estate industry in particular is also under enormous pressure to change, because real estate causes almost 40 percent of global greenhouse gas emissions and investors are demanding sustainably developed ESG-compliant real estate projects.

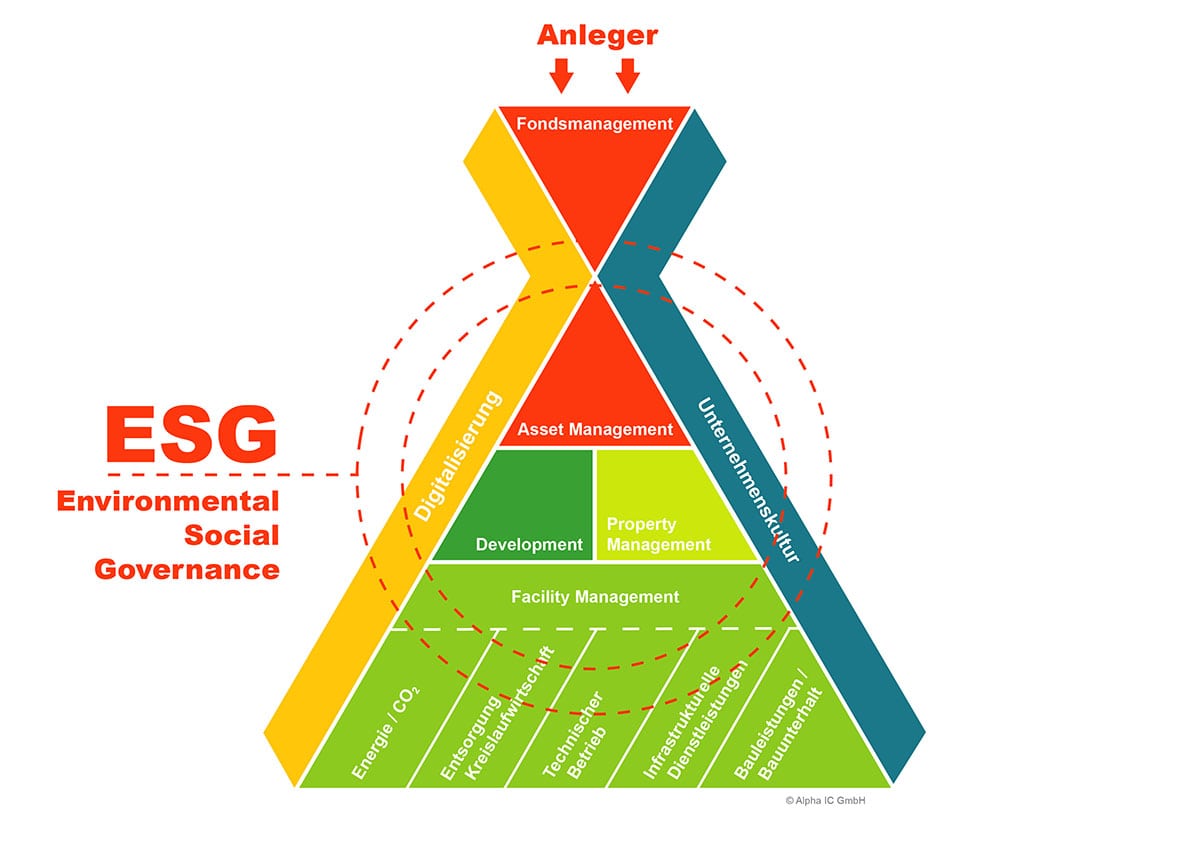

As one of the leading consultancies for real estate management, Alpha IC GmbH is currently feeling the market pressure on its clients. Against this backdrop, this eight-part blog series deals with solutions and concepts for questions and needs of the various players and developments in this transformation process.

Part 1: Status quo of a transformation process - ESG in real estate practice

ESG is also coming into focus for the real estate industry as a result of regulation at European and national level. The reporting obligations from the Taxonomy Regulation and the Disclosure Regulation of the European Union create a de facto compulsion for the real estate industry to collect and transmit building and sustainability data. However, the dilemma currently lies in the fact that concrete requirements are not yet in place, or only in part. For the Taxonomy Regulation, there is so far only the final legal act on the technical assessment criteria of two of the six environmental objectives. Not to mention the topics of social taxonomy and criteria for assessing sustainable corporate governance. The classification of so-called Article 8 and Article 9 products under the Disclosure Regulation is also driving the market, as the demand for ESG-compliant investment products is increasing significantly and thus also the motivation to launch sustainable funds. See also our article "Many shades of green? – Catergorisation of financial products according to ESG"[DMB1]. Which environmental or social characteristics should be used for an Article 8 or Article 9 product? Unfortunately, the taxonomy is of limited help here, as it has only been developed for the climate sector so far, whereas Article 8 and Article 9 cover the entire environmental spectrum and also social characteristics. In summary: the topic of "sustainability" has arrived in the real estate industry. All players are supposed to act in an ESG-compliant manner. But what does that mean in practice? There is still a lack of approaches to make ESG applicable to all aspects of real estate management.

No wonder that the market is noticeably unsettled as to what it should do with respect to ESG. Rating systems such as the GRESB and the industry initiative ECORE scoring are trying to fill this gap in the short term. GRESB has not yet gained acceptance on the European market because the rating system is seen by many market participants as very time-consuming and costly. In addition, the German BaFin sees the scoring as insufficient to classify a fund as Article 8 (light green) or 9 (dark green). The hope is that the European counterpart ECORE will establish itself as an industry standard after the pilot phase. More than 80 investors and portfolio holders have now joined this industry initiative and hopes are high to establish a workable standard for measuring ESG compliance.

As a result of this uncertainty about which steps to take in terms of ESG, stagnation[DMB1] is setting in. We feel this uncertainty from enquiries to our company:

- Is my property Article 8 or Article 9 compliant?

- Which ESG criteria must my development project fulfil to attract investors and obtain good financing conditions?

- Is green building certification sufficient to meet the requirements?

- How do I establish ESG-compliant reporting and where do I get the data?

- How do I install ESG management and how do the roles of REM[DMB2] actors change?

- Which ESG-relevant measures are eligible for subsidies? Which can be passed on to the tenants?

- What impact does ESG have on my corporate culture?

Only a few players in the sector are already fully prepared for this transformation process. One pioneer in this respect is alstria office REIT-AG, which strategically integrated the topic into its service portfolio ten years ago. For example, at the last annual general meeting, the listed Reit managed to get shareholders to waive 1.9 percent of their dividend in favour of investment in sustainability. The proposed amount corresponds to the value of CO2 not paid for in operations within the last reporting period. In addition, alstria goes one step further and focuses in its low-carbon principles not only on operational emissions but also on construction emissions.

Robert Kitel, Head of Sustainability & Future Research at alstria office REIT-AG, comments:

"Constructing a building today causes as much CO2 as the total future emissions from 50 to 60 years of use. That's why we will have to modernise existing buildings and use them for longer, instead of turning to demolition and new construction as we have done in the past."

Unlike with the pioneer alstria, the discussion about sustainable real estate is often not intrinsic. Instead, the pressure to change usually comes from outside - from regulation and the increased expectations of investors. The lack of a deep-seated and fundamental stance on sustainable development leads to additional uncertainty among market participants.

In his assessment of the current situation, Prof. Dr.-Ing. Christian Meysenburg, Head of the Real Estate and Facility Management course at the SRH University of Applied Sciences in Heidelberg, considers that the majority of companies are not prepared for the development and sees a need for action in the short term, especially in the area of data availability:

"End-to-end, digitalised and reliable data collection for ESG verification purposes is unfortunately not yet established to the extent that it could be. In the short term, therefore, the question arises as to how to proceed to minimise interface losses and efforts between investor, AM, PM and FM quickly and efficiently. In the medium term, questions about "grey energy" will also come to the fore. What should actually be done with properties that are still needed but are actually to be classified as stranded assets from a CO2 point of view? Can energy-intensive replacement buildings be the right answer there?"

The fact is that sustainable property portfolios proved to be significantly more resilient during the Covid 19 crisis, for example. Among others, a recent study by "The Economist Intelligence Unit" commissioned by the major Swiss bank UBS finds that seven out of ten investors confirm that their company's investments that integrate ESG factors have "performed" better financially than comparable traditional investments. A holistic governance approach and a motivated corporate culture intrinsically focused on sustainability and ESG seem to pay off not only for the planet, but also for returns. (Source: UBS Asset Management Global: Resetting the agenda. How ESG is shaping our future, 2021).

Based on this status quo, it is clear that we need to rethink our strategic orientation. Approaches such as climate risk analyses, decarbonisation path, definition of a job profile for ESG managers, green leases, etc. must be integrated and established in the advisory work. This involves serious changes in processes, interfaces and remuneration models. These organisational and investment changes do not happen overnight, but it is important to start. It is completely normal that different challenges arise for the different players in the property market. For example, a fund manager has different interests and requirements to consider than a classic project developer. We will address these specific issues and perspectives in the ESG transformation process in the next blog post.

Future contributions to the blog series: ESG in Real Estate Practice

Part 2: Perspectives and needs of stakeholders

Part 3: Challenges for development

Part 4: TDD and ESG compliance

Part 5: Digitisation needs for delivering evidence

Part 6: Roadmap for a new corporate culture

Part 7: Meaningful rating versus greenwashing

Part 8: Whitepaper: ESG in Real Estate Practice: Plea for a Holistic Approach.

Your contact persons at Alpha IC:

Barbara Bestmann, Consultant Alpha IC

Tel. +49 151 422294 - 54 ∙ b.bestmann@alpha-ic.com

- Green Building & ESG Consulting

- Strategie & Organisation

Patrick Mahler, Senior Consultant Alpha IC

Tel. +49 151 422294 - 29 ∙ p.mahler@alpha-ic.com

- Green Building & ESG Consulting

- Leed AP, DGNP RP

- Digitalisierung