ESG - an abbreviation that has been putting pressure on players in the real estate industry to act since last year at the latest. The term was already coined in 2006 and stands for a more holistic approach than corporate social responsibility. The "E" for Environmental adds aspects such as climate, scarcity of resources, water and biodiversity to the "S" for Social (including employees, safety, health) and the "G" for Governance (including corporate management and culture).

So far, ESG has not been a defined term in Europe-wide or international standards. But the Sustainable Finance Action Plan and the related Taxonomy and Disclosure Regulation of the European Union (EU) contain binding criteria and classifications for companies and financial market actors for the first time - even if not yet comprehensive for all aspects of ESG. Nevertheless, it becomes clear that sustainable development involves much more than achieving climate neutrality by 2045 in Germany.

As a contributor to almost 40 per cent of global greenhouse gas emissions, the real estate industry is under enormous pressure to transform. In addition, investors, buyers and clients are increasingly demanding sustainably developed, ESG-compliant, real estate projects. The "sustainability" theme has thus arrived in the real estate industry and all players are expected to act in an ESG-compliant manner. But what does this mean in practice?

Alpha IC GmbH, one of the leading consulting firms for real estate management, is currently experiencing the pressure to act and the irritation of the market in numerous mandates. Against this backdrop, this eight-part blog series deals with approaches and concepts to questions and needs of the various actors and developments in this transformation process. In the fourth blog part, the focus is on questions around an ESG DD in contrast to the "classic" due diligence reviews conducted in the context of a transaction.

Part 4. TDD and ESG compliance

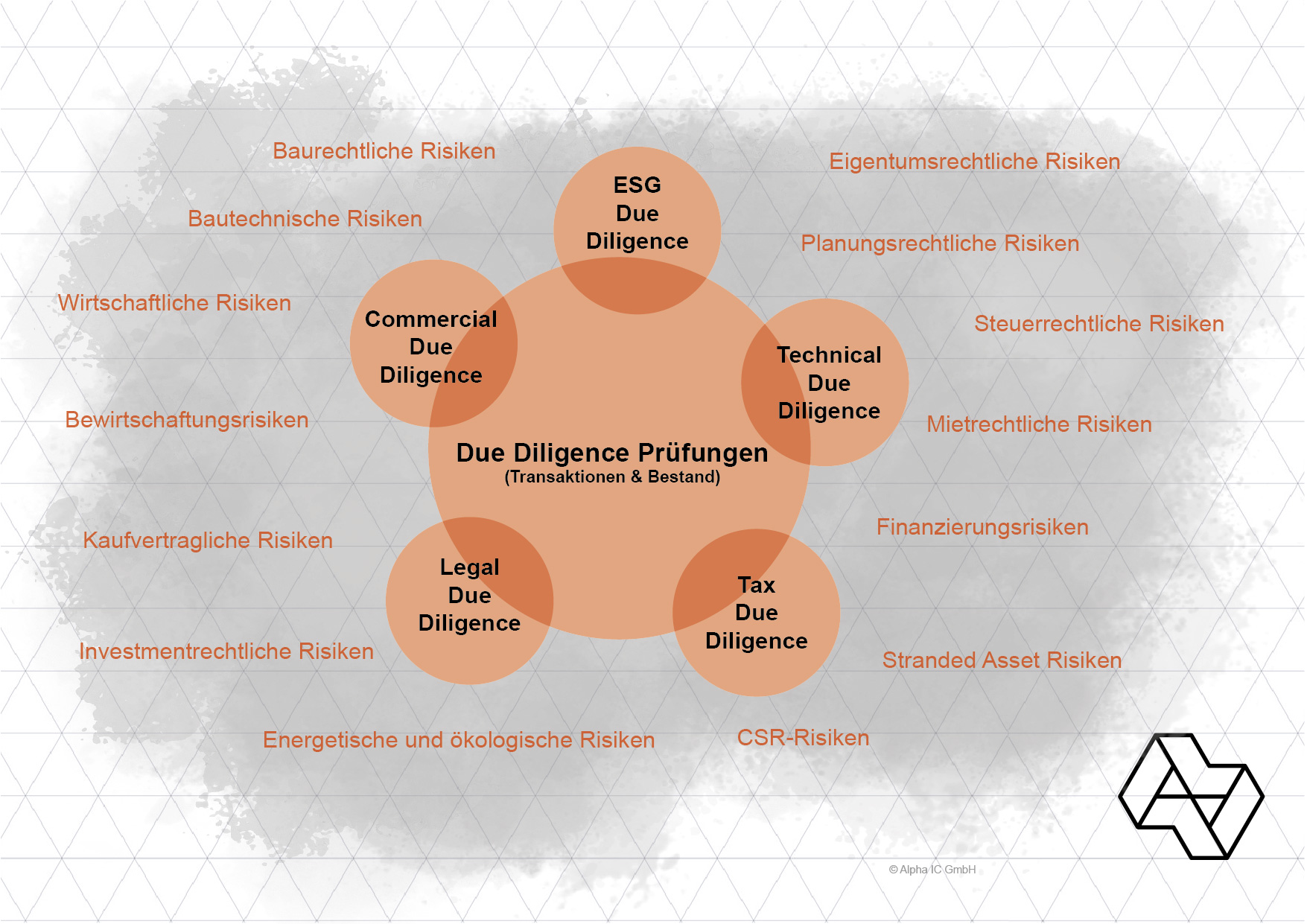

Anyone who wants to acquire a property needs detailed information regarding its condition and its future security. Within the scope of a due diligence, the property is usually examined from a financial, technical, legal and tax perspective. The aim is to determine an appropriate purchase price and to exclude or scale possible risks.

The Disclosure Regulation requires the integration and disclosure of sustainability risks in the investment process, as well as the necessity to check properties for their "taxonomy conformity" for sustainable financial products. This results in new challenges for the due diligence of properties. Furthermore, it is necessary to query ESG criteria that real estate companies have imposed on themselves apart from the reporting obligations in order to comply with the overarching ESG goals at the corporate level.

ESG, the acronym that stands for Environmental, Social and Governance, is often used synonymously with the term sustainability. In particular, the EU regulation, which is continuously adopted based on the Sustainable Finance Action Plan of the EU Commission (including the Disclosure Regulation and the Taxonomy Regulation), forms the legal framework. ESG thus stands in the narrower sense for the implementation of regulatory requirements, but also for a holistic and sustainable view of the (real estate) value chain.

In addition to the "traditional" due diligence components mentioned above, ESG due diligence (ESG DD) is therefore becoming increasingly important. It is a building block of a sustainable real estate value chain that is establishing itself in the market, particularly due to regulatory requirements.

In addition to regulation, however, it is also the foresight of market participants with regard to the so-called risk of stranded assets that is feeding the demand for ESG DDs. This is a property that has a negative performance on the decarbonisation path and does not reduce CO2 emissions in time according to the sector targets (minus 55% by 2030, 0% in 2045). Disadvantages from this can result either in the form of devaluations of affected properties or possible sanctions such as CO2 levies. The worst case scenario would be that real estate actually becomes stranded and can no longer be traded on the real estate market.

An ESG DD thus provides an important building block for identifying risks at an early stage, pricing them into the purchase price and initiating measures to maintain a sustainable property. In addition, the results of an ESG DD are an important component for calculating a property return. Raffael Haisch, authorised signatory of CPM GmbH, also sees ESG DD as an opportunity for a long-term real estate strategy:

In the context of TDDs, properties that are in operation (in the long term) are usually to be changed. Potential buyers are interested in increasing the value of the property through certain structural upgrades or user-specific adaptations. Cost-benefit considerations are in the foreground and essential requirements of a future-proof real estate investment are pushed into the background due to economic considerations. In contrast, an expansion of the classic TDD around CapEx through measurable ESG criteria with regard to construction and operation raises awareness and enables buyers to develop a long-term real estate strategy.

So what exactly is ESG DD?

The aim of ESG due diligence is, as the name suggests, to take a closer look at various criteria of the E, S and G aspects to map the current building performance against sustainability criteria. Depending on the assignment, an ESG DD can also deal with concrete measures for optimisation. Currently, ESG DDs are often limited to environmentally relevant factors - i.e. essentially to energy aspects. However, in our view, the three topic clusters must be considered holistically, so that in addition to the topic area "environment", "social" and "good corporate governance" can increasingly be considered.

A major challenge of ESG DD, which should not be underestimated, is in obtaining ESG-relevant, property-specific documents. For ESG due diligence, one needs direct access to data on the building or company. The depth of detail and scope vary from transaction to transaction and requires flexibility. The goal is always with the right amount of due diligence to enable an informed decision.

The scope of an ESG-DD is compiled from a set of criteria that enable an individual status quo analysis and recommendations for future value maintenance or enhancement. The selection of possible criteria can be guided by recognised frameworks, such as the RICS Redbooks, and supplemented by the use of commercially available tools.

In addition to the technical assessment of, for example, consumption and the associated efficiency in energy, water and waste management, we also consider the social criteria, such as health, well-being and user involvement. We also consider mobility, digitalisation and the quality of interior and exterior space. Governance topics can be individually compiled for each ESG due diligence, including compliance, money laundering, etc.

In a further step, we examine the basic certifiability of the property according to the common green building systems such as DGNB, LEED and BREEAM DE. If desired, we also offer a natural hazard analysis, a review of compliance with the EU taxonomy and an analysis of stranded asset risk for real estate (CRREM tool). In addition, ESG scores are determined using recognised industry standards (e.g. ECORE, GRESB) and the results are evaluated for the client.

Consequently,

the integration of ESG aspects into the value chain of real estate - first and

foremost into the acquisition process - changes the DD consultancy service and

requires broad know-how, which should be mapped by a team of technically,

sustainably versed advisors and real estate economists.

What are the interfaces and intersections between ESG DD and TDD?

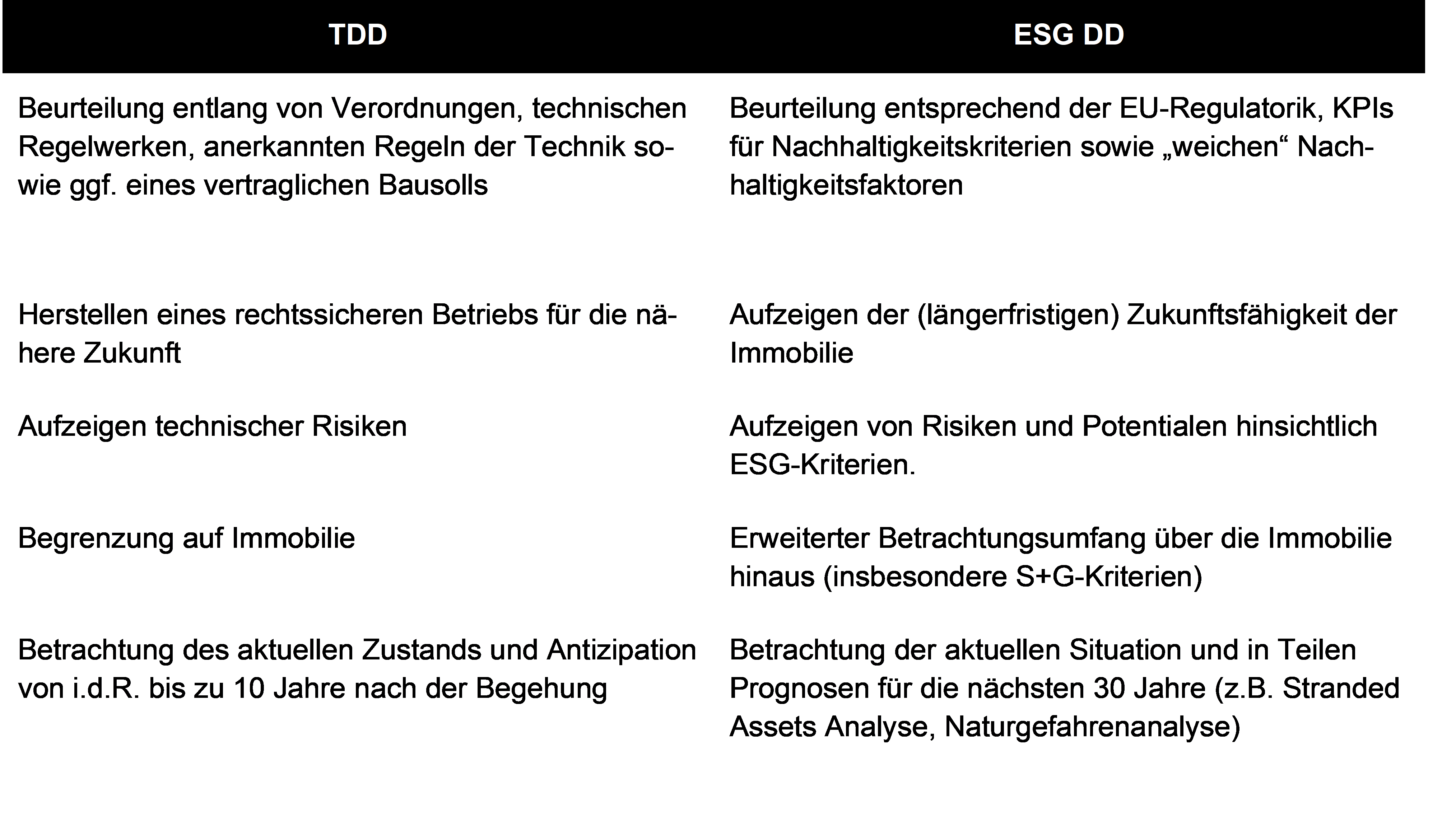

Particularly in the area of technology and the environment, ESG DD creates interfaces and overlaps with classic technical due diligence (TDD) that need to be harmonised. But what actually constitutes ESG DD and how does compare with technical DD?

ESG DD represents more than a mere ticking off of standardised checklists. ESG in all its facets is thematically comprehensive and ultimately - despite all attempts to measure sustainability - always building- and company-specific.

Technical due diligence, on the other hand, is easier to delineate in terms of its primary purpose and is also subject to standardisation and best practice due to its many years of application. In contrast, the process of standardisation and enforcement of customary market standards is still in its infancy in ESG DD.

Even though both investigations go under the name of due diligence, a closer look reveals significant differences between ESG DD and TDD, as the following comparison illustrates:

Despite all the differences between ESG and technical DD, there are also similarities in the assessment of properties under transaction. In essence, it is about the assessment of a property and its structural, technical and organisational design as well as the development of potentials.

Both studies also have in common that the transaction process is often extremely time-critical and at the same time very time-intensive. Nevertheless, it is important to always analyse the respective cost- and risk-relevant aspects.

For service providers and clients of TDDs and ESG DDs, the question arises whether both services can be carried out in one go, i.e. in one report and with the same team, while exploiting as many synergies as possible. Even if a "streamlining" would be desirable, this can only actually be realised in a few cases. The reason for this lies in the different focal points of the two DDs: While the TDD mainly requires personnel with constructional-technical know-how, the ESG DD requires deep knowledge of sustainability criteria as well as regulatory requirements. In our opinion, both examinations will therefore run in parallel in the future and have their justification.

Dr Achim Johannis, Managing Director of assetecture GmbH, goes a step further in his assessment of the developments of the two due diligence disciplines:

"Technical due diligence is subject to constant, dynamic further development. In its early days, the discipline was limited to largely isolated analyses of technical deficits and risks. Today, market-leading players condense the findings into future- and opportunity-oriented projections of optimised technical development paths, taking interdisciplinary legal, economic and strategic aspects into account. Considering the fundamental importance of ESG aspects on the client side and their simultaneously diverse technical interdependencies, an increasing convergence and integration of TDD and ESG due diligence services will also prevail on the market in the medium term. "

Interests and objectives of an ESG DD from the perspective of different market participants?

Every due diligence can be viewed from the perspective of different players in real estate management. The typical perspective is that of the buyer. A careful examination should be carried out to identify the risks of a purchase as comprehensively as possible and to incorporate them into the property valuation and purchase contract negotiations. This often results in a conflict between due diligence and the purchase timeline.

The "counterpart" of the buyer is the seller or portfolio holder who usually wants to know already in the portfolio maintenance phase what major risks exist and take them into account for the ongoing operation and value retention of the property. In the course of preparing a transaction, vendor due diligence initiated by the seller is also used to provide the buyer with his own view of the property and possible factors influencing the purchase price at an early stage, to advance purchase decisions.

The regulated financial market participant as a portfolio holder (e.g. AIFM, insurance companies) is disproportionately more diverse in its organisation and has a number of actors, each of which evaluates DD according to a different reading: usually at least fund and risk management and, in addition, frequently asset and property management.

A new addressee of ESG DD information is the user/tenant. Commercial operators in particular want to better understand and assess ESG risks and attach importance to property certification.

The diverse group of clients and addressees of an ESG DD shows how different the required information and its further use is. This must be taken into account when processing the individual data and risk situation of a property and the subsequent preparation of the ESG DD.

How important will ESG DD be in the future compared to TDD?

At present, it is not possible to make a precise statement about the impact of ESG DD on the market value of a property. Specialist articles speak of a range of -10 % for properties with a poor ESG scoring to +25 % with a good ESG scoring (position paper ESG in the real estate industry, Oct. 2021, PwC/RICS). In our opinion, however, this corridor only represents a snapshot of current market events and should not be regarded as fixed. Ultimately, the market decides the price. And the influence of a sustainable real estate value chain on the price will, in our opinion, increase strongly in the coming years.

Identifying and calculating (ESG) risks is a central part of an acquisition due diligence. Within the framework of the economic assessment, ESG risks become ESG potentials: CapEx measures are prioritised, optimised in terms of planning and taxation and finally priced. Forecasting their effects on the property value, and thus the property return, provides a complete basis for decision-making and the best conditions for holistic ESG management in the holding phase of a property. Marion Paroli, Head of ESG at Coros, also considers the potential of an ESG DD in this sense:

"Environmental, social and corporate criteria are becoming increasingly relevant in real estate transactions - even in the early acquisition phase. For this reason, an ESG due diligence, which ideally runs parallel to the technical DD, should assess the the property as it is and work out the potential with regard to its future ESG performance. Energy considerations and the determination of CO2 emissions are just as important here as soft factors regarding wellbeing or the observance of defined exclusion criteria. Findings from an ESG due diligence can - just like those from a technical or legal DD - influence the purchase price and are therefore of significant relevance to the risk assessment."

A holistic ESG DD assessment reveals optimisation potential with regard to environment, social and governance. Using these potentials brings us closer not only to achieving the climate goals, but also the social and societal Sustainable Development Goals of the UN. This change in the quality of cooperation and coexistence results in an impact that can be positively monetised beyond the audited property.

It can be assumed that ESG DD will be given comparatively high priority in the future. However, TDD will by no means lose its justification and will remain a necessary part of the transaction process by continuing to explicitly assess and evaluate technical risks.

Future posts in the blog series: ESG in Real Estate Practice

Part 5: Digitisation requirements for the provision of evidence

Part 6: Roadmap for a new corporate culture

Part 7: Meaningful rating versus greenwashing

Part 8: Whitepaper: ESG in Real Estate Practice: Plea for a Holistic Approach.

If you would like to read the previous parts of the series, please click on the respective link:

- ESG in Real Estate Practice. Status quo of a transformation process

- ESG in Real Estate Practice. Perspectives and needs of the actors

- ESG in Real Estate Practice. Challenges for development

Your contact persons at Alpha IC:

Sophia Stettner, Junior Consultant Alpha IC

Tel. +49 151 422 294 - 09 ∙ s.stettner@alpha-ic.com

- Green Building (DGNB Registered Professional)

- TDD and ESG DD

- Climate & Building Physics

Lukas Weigert, Senior Consultant Alpha IC

Tel. +49 151 422 294 - 31 ∙ l.weigert@alpha-ic.com

- Green Building (LEED AP)

- Technical due diligence

- Energy & Technology

- Commissioning

management (IBM)