Introduction

ESG - an abbreviation that has been putting pressure on players in the real estate industry since at least last year. The term was coined in 2006 and stands for a more holistic approach than Corporate Social Responsibility. The "E" for Environmental adds aspects such as climate, resource scarcity, water and biodiversity to the "S" for Social (including employees, safety, health) and the "G" for Governance (including corporate management and culture).

ESG was not yet a defined term, and there were no Germany- or Europe-wide standards. But the Sustainable Finance Action Plan and the related taxonomy and disclosure regulation from the European Union (EU) contain binding criteria and classifications for companies and financial market players for the first time - although not yet comprehensively for all aspects of ESG.

The ambition and pace of turning the EU's economy "green" are ambitious, as the ultimate goal is climate neutrality by 2050, with an important milestone agreed to reduce emissions by at least 55 percent by 2030 compared to 1990 levels. With the amendment to the Climate Protection Act in August 2021, Germany is to become climate neutral as early as 2045.

To achieve these climate and sustainability targets, the participation of all sectors of the economy in this transformation process is necessary. The real estate industry in particular is under enormous pressure to change, as real estate is responsible for almost 40 percent of global greenhouse gas emissions. In addition, investors, buyers and clients are increasingly demanding sustainably developed, ESG-compliant real estate projects.

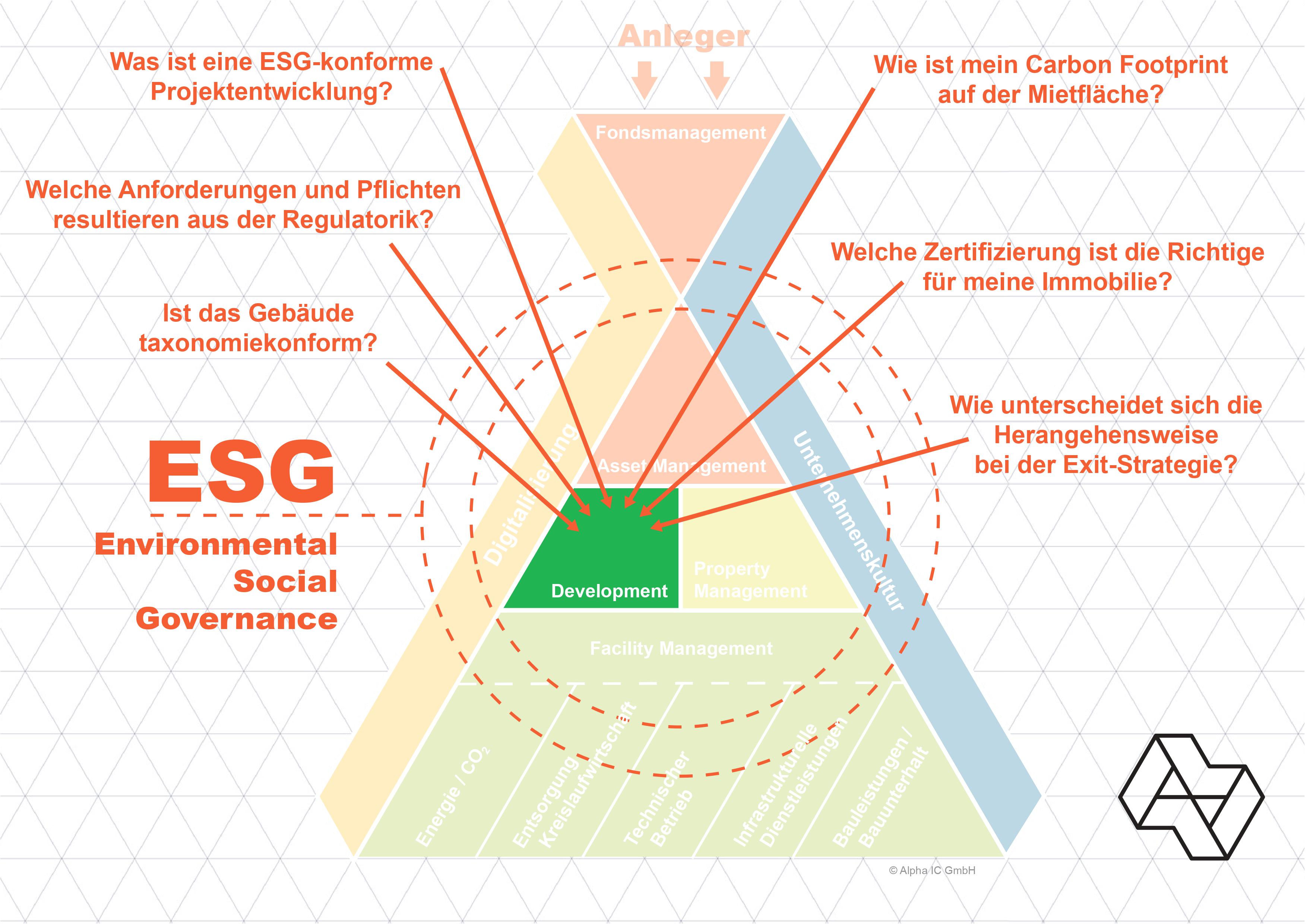

Alpha IC GmbH, one of the leading consulting firms for real estate management, is currently seeing that the market is under pressure to change ad irritated by the range of demands. Against this background, this eight-part blog series is about approaches and concepts to questions and needs of the different actors and developments in this transformation process. The third part of our blog series deals with the challenges of developing a project in an ESG-compliant manner.

Part 3: Challenges for development - ESG in real estate practice

Irrespective of the regulations, the topic of ESG and sustainable finance is reaching developers with a force for which no one was really prepared. This is because the course of project development must ensure good ESG performance for potential investors and financiers, ergo to reduce the default risk/market risk. If the building is held in the company's own portfolio and/or transferred to a corresponding fund, there is direct pressure to take action with associated reporting obligations. Depending on the role, the necessary actions differ. For example, while all stakeholders require consumption data, a developer does not need to implement an ESG data management system to populate sustainability reporting. Since regulatory compliance is in part not very concrete and in constant flux, our experience recommends a materiality analysis that identifies the relevant action areas in terms of environment, company and stakeholders. Companies must prepare themselves for the fact that the measures taken will also be scrutinized more critically as interest grows. At the end of this chain are the investors, who take a close look at what sustainability really entails in the projects and thus become a serious corrective force.

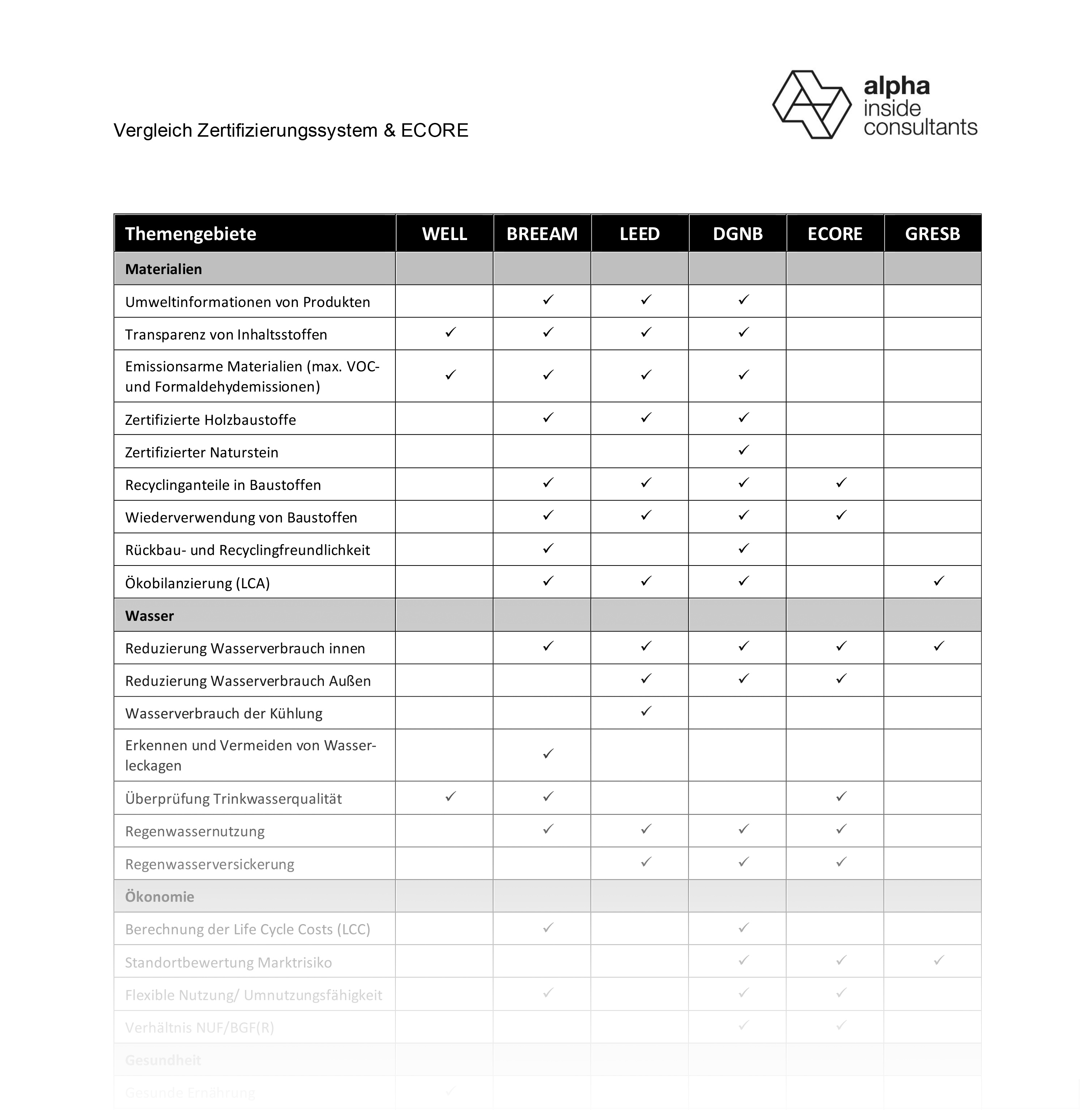

At the project level, numerous certification systems have become established in the sustainability sector in recent years. Whether it is DGNB, LEED, BREEAM or WELL, one thing is certain, regulation is leading to the associations having to further develop and supplement the existing catalogues of criteria for certification. Currently, there are gaps in some areas that need to be closed in the project developments and are uncovered via so-called ESG and/or taxonomy checks. More on this point later. Currently, it is not sufficient to implement only a green building label for project development. It turns out that this does not cover some requirements, e.g. for a property categorized under Article 9, and thus exposes the developer to the risk of not placing the property in a sale to a fund.

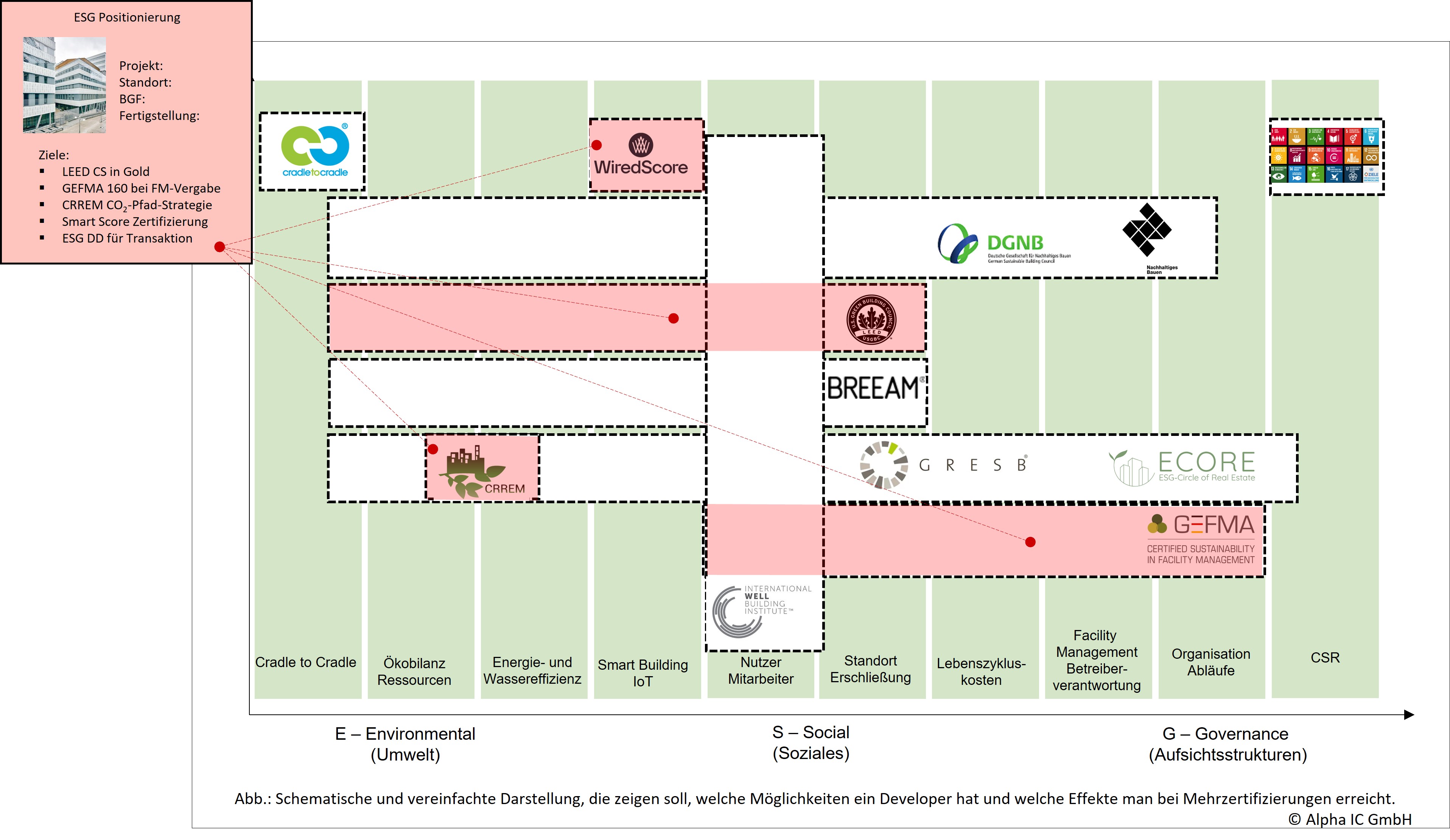

We generally perform ESG positioning for our clients in our projects. This involves formulating sustainability goals based on the strategy of the developer and the property, and describing the measures to be taken. In the meantime, multiple certification in combination with SmartScore, CradleToCradle, GEFMA or further is becoming more and more common in order to get one step further by combining mature and market-compatible procedures. In the projects, the role of the "certifier" is thus changing very strongly in the direction of a "sustainability (ESG) coordinator", see also Part 2 of this blog series.

The following graphic shows an example of a project in which the outlined ESG positioning and its components are illustrated:

A clear direction is the need to anticipate the requirements of the EU regulations. Thus, the projects should be as taxonomy-compliant as possible according to the economic activities of new construction or refurbishment, as well as have sufficient characteristics for inclusion in an Article 8, 8+ or 9 fund according to the Sustainable Finance Disclosure Regulation. The synergies with the established certification systems are clearly recognizable and can be worked out, for example, in a preliminary examination for taxonomy conformity. Due to the different ways in which certification can be implemented and the different environmental objectives that can be considered in the taxonomy, there is no general statement on the extent of synergies. Our taxonomy check therefore examines real estate projects in terms of their compliance with the taxonomy assessment criteria and environmental sustainability. The classification of projects according to Article 8, 8+ or 9 of the Sustainable Finance Disclosure Regulation contained therein also helps to develop projects in compliance with the taxonomy - whether for new construction or redevelopment.

Depending on the exit strategy, issues such as smart metering, waste capture, or ESG-compliant FM must always be considered. Project developers must also have ESG benchmarking systems on their radar. For example, the ECORE and GRESB systems will be given a central role in comparability when it comes to inventory management, which means that project developers should also be aware of and take into account the evaluation criteria they contain. A comparison of the rating systems, as indicated below, has proven to be very helpful in this regard.

A second direction of travel towards ESG compliance can be found in the topic of decarbonization. Through initiatives such as the "Net Zero Asset Managers Initiative", the majority of market participants recognize the urgency of decarbonizing the building sector and commit themselves through a Net Zero Pledge to climate-neutral building operation by 2050 at the latest. Here, the foundation must already be laid in project development that climate-neutral operation is to be achieved by 2050 at the latest. For this purpose, the CRREM tool offers an already widely used "stranded asset" approach. The goal is to steer an individual asset or portfolio toward compliance with the 1.5-degree (or 2-degree) scenario. The tool is also incorporated in the ECORE and GRESB ESG benchmarks and provides an important indication of a property's sustainability. Since the influence of the REIM is mainly in the selection of heating/cooling provision, an important lever can be directly influenced.

However, since an equally important lever, electricity consumption in the rental spaces, is not directly in the hands of the project developer, collaborative approaches with tenants and/or service providers will be equally in demand. Here, a cross-building "ESG story" comes into focus with which one connects tenants and landlords. Especially when tenants are driving the issue through their own ambitions or due to their reporting obligations, aspects of sustainable building operation (green leasing, ESG-compliant FM, energy optimization, energy-saving contracting, etc.) are in the interest of all parties involved.

For Allgemeine SÜDBODEN AG, the two board members, Maximilian von der Leyen and Philipp H. Schröder, summarize their approach to sustainable project development and the related challenges as follows:

"As a project developer that has most of its projects in in its own portfolio, we have always had a special interest in developing our properties sustainably. For many years, we have already involved building biologists and sustainability consultants in the development process. ESG-compliant real estate development finds the best compromise between costs and benefits, between preservation through modernization and new construction - ultimately, the path for buildings and climate protection that makes the best use of resources and advances climate protection in a transparent way. The biggest challenge for us as developers of real estate is to make sustainable real estate and green energy attractive to tenants. Because these are currently still mostly associated with higher costs."

For the individual developer, there is an opportunity to achieve a "unique selling proposition" through a credible sustainability strategy at the corporate level beyond regulatory compliance and marketing campaigns. As the requirement for ESG compliance offers a wide range of possible actions, this is also likely to see a wide variation in the market. So even if such a stance is not intrinsically motivated, it at least provides competitive advantages. The basic principle of regulation is transparency, so it will become all the more important to credibly stand up for the issue of sustainability and to anchor this convincingly in the corporate culture, in the organizational structure, and in the projects.

For example, the "social" of ESG may also become a greater focus in a project development than has been the case to date. This is evidenced by an increased request for certification to the WELL Building Standard, which, spurred by the "War for Talents" and "New Work," is becoming a central focus for new office development. Potential employees want to know what their future employer's attitude and actions are in terms of sustainability. This aspect is increasingly becoming a hard fact in employer branding.

The following interview with Dr. Christoph von Carlowitz, Chief Representative and Head of the Executive Board Department of GLS Gemeinschaftsbank eG, makes it clear once again, especially with regard to the topic of financing, what impact sustainable project development can have

Many developers commission an ESG check at Alpha IC in order to get good credit conditions or to get a loan at all; why are there better conditions for an ESG-compliant project?

GLS Bank only finances ESG-compliant projects. This is part of our self-image as a social-environment-oriented bank. We have outlined the reasons and requirements in our investment and financing principles on our website.

Why and when does the bank assess the risk of an ESG-compliant project lower?

We see lower physical and transitory risks in ESG-compliant projects. Such risks exist not only in the form of damage risks in potential flood areas, but at all locations, e.g. in the expectation of future internalization of previously external costs, e.g. in the form of levies on CO2 emissions or even in usage bans.

What is GLS Bank's general stance on the ESG compliance of projects?

We have been assessing the environmental and social responsibility of projects in our banking business for over 40 years. We have defined our requirements in our mission statement and the above-mentioned principles. However, we are also guided by the Paris climate targets and the UN Social Development Goals, for example. We also believe that compliance with these goals is necessary in the real estate industry. Compliance with 1.5°C goal for a project is ambitious - but possible and necessary.

With regard to possibly rising interest rates this year, will these rise equally for "green investments"? Or will there be a difference in products here as well?

Interest rates should not be viewed in isolation from risks. In my opinion, no difference is made in the products just because the investments are considered "green". If, for example, nuclear energy is indeed to be considered "green" according to the EU taxonomy, this technology is nevertheless associated with the known risks. Market participants will take these risks into account and - if they invest in such technologies at all - will also take the higher risks into account in the calculation of interest rates. Another aspect for the interest rates for "green investments" is supply and demand. It is to be expected that green investments will be weighted more heavily in demand not only because of the lower risks associated with them, but also on the basis of changed value perceptions - this will probably have the effect of increasing prices and thus decreasing yields for green investments.

It has become clear that classical development alone, even if only indirectly affected via financing and investors, is subject to great ESG pressure to act. Much is in flux or not yet precisely defined. At the same time, it is becoming clear that new construction that does not achieve the "Net Zero" goal by the time of completion entails a market risk. Alpha IC advises with many years of expertise and intrinsic motivation for sustainability, so we are well prepared for your questions and tasks

Future posts in the blog series: ESG in Real Estate Practice

Part 4: TDD and ESG compliance

Part 5: Digitization needs for evidence delivery

Part 6: Roadmap for a new corporate culture

Part 7: Meaningful rating versus greenwashing

Part 8: Whitepaper: ESG in Real Estate Practice: Plea for a Holistic Approach.

If you would like to read the previous parts of the series, please click on the respective link:

Part 1: ESG in Real Estate Practice. Perspectives and approaches

Part 2: ESG in Real Estate Practice. Perspectives and needs of the actors

Your contact at Alpha IC:

Patrick Mahler, Senior Consultant Alpha IC

Tel. +49 151 422294 - 29 ∙ p.mahler@alpha-ic.com

- Green Building & ESG Consulting

- Leed AP, DGNP RP

- Life-cycle Assessment