ESG - this is an abbreviation that has put pressure on players in the real estate industry to act since 2021 at the latest. The term stands for holistic sustainability management and is made up of the "E" for Environmental (including resource conservation, water protection, protection of biodiversity), the "S" for Social (including occupational safety, health protection) and the "G" for Governance (including compliance with legal requirements, good corporate governance).

The EU Commission's Sustainable Finance Action Plan will translate this definition of sustainability into legal requirements for the entire European Union. These include the already adopted Taxonomy Regulation and the Disclosure Regulation of the European Union, which for the first time define binding disclosure requirements and categories for sustainable economic activities. Both regulations apply to financial market participants and financial advisors, but their requirements already have spillover effects into the entire real estate industry (including real estate financing, valuation, and rentability).

On June 21, 2022, the Council and the European Parliament reached a preliminary agreement on the Corporate Sustainability Reporting Directive (CSRD). With the CSRD, companies from a wide range of industries that do not have a direct link to the financial market also move into direct legal concern. For companies already subject to the NFRD, the regulation applies to fiscal years beginning on or after January 1, 2024. Large companies not currently subject to the NFRD will be required to apply the regulation beginning January 1, 2025. "Large companies" are defined by meeting two of the following three criteria: average total assets > €20 million, average net sales > €40 million, or average number of employees > 250. Capital market-oriented small and medium-sized companies, certain small and non-complex credit institutions, and insurance captives are affected for fiscal years beginning on or after January 01, 2026.

In addition to the EU ESG regulatory framework, the fact that the real estate industry is the source of almost 40 percent of global greenhouse gas emissions in particular is triggering enormous economic, but also socio-cultural, transformational pressure: Investors, financial institutions, real estate buyers, tenants but also employees demand a rethinking towards a sustainable real estate value chain. In addition, owners need to identify sustainability risks at an early stage and manage them adequately (e.g. stranded asset risk; cost risks from CO2 rent).

The topic of "sustainability" has thus arrived in the real estate industry and all players should get started.

Alpha IC GmbH, one of the leading consulting companies for real estate management, is currently experiencing the pressure to act and the irritation of the market in numerous mandates. Against this background, this eight-part blog series is about approaches and concepts to questions and needs of the various players and developments in this transformation process.

In the fifth blog part, everything revolves around the topic of digitalization and the fact that achieving ESG goals requires valid data. It is the key to professional implementation of ESG guidelines, according to 84 percent of respondents. Data and its evaluation are the basis for professional ESG management for 87 percent of the participants in the fifth digitalization study by ZIA and EY Real Estate. 84 percent think that digitization is the key to professional implementation of ESG guidelines.

Digitization as a driver for ESG transformation

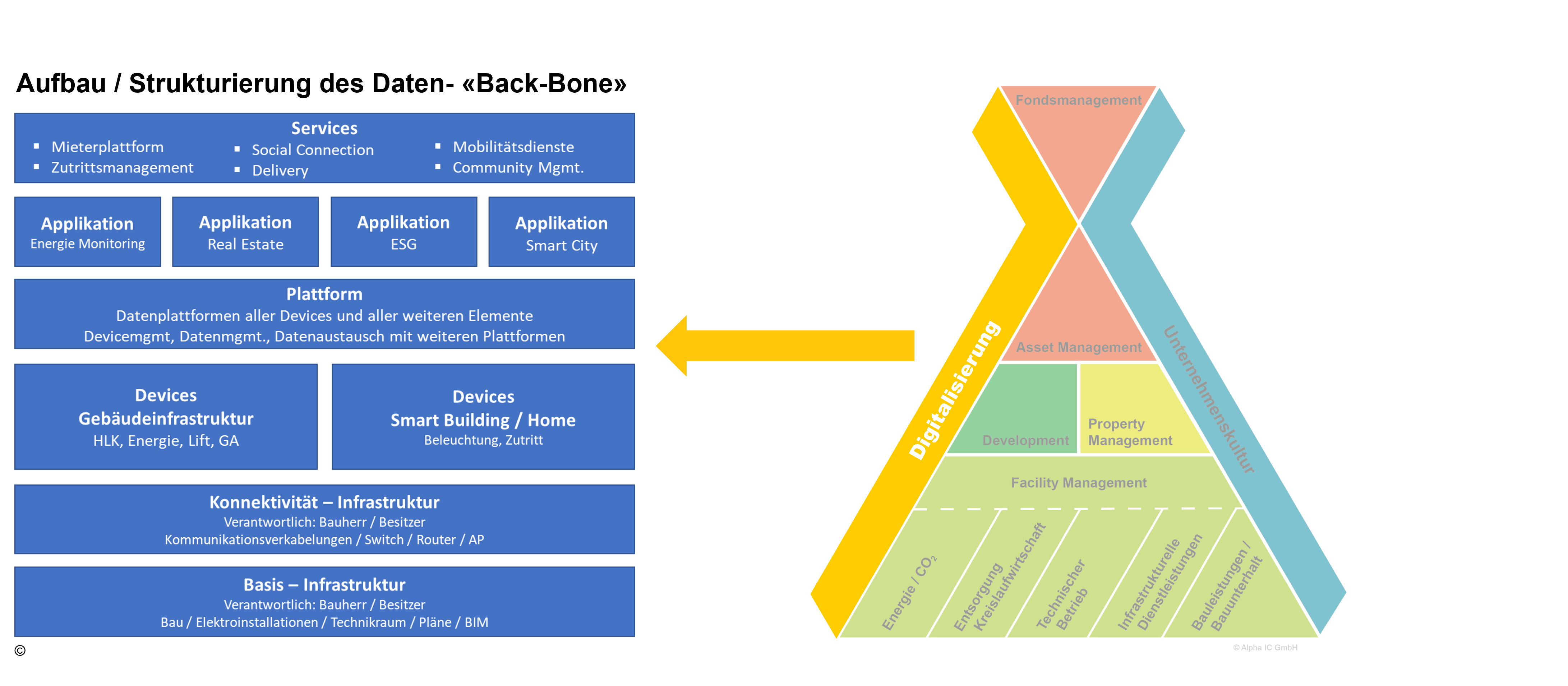

Digitization inevitably plays an essential and central role in ESG issues. After all, it is only through a smart infrastructure in which the sustainability aspects of a property are mapped that it is possible to manage the ESG criteria of real estate. Due to extensive advances in digitalization, owners, operators and users of real estate increasingly have the ability to measure specific ESG criteria such as media consumption of parts of the building and the impact of user behavior. This often results in comprehensive consumption monitoring concepts and the owner gets clarity on the effective sustainability performance of his real estate. One specific tool of digitalization used in measuring sustainability criteria is not only meters, but also so-called IoT devices. A report by Huawai shows that by 2025, more than 100 billion IoT devices will be connected, continuously transmitting measurement data and information (source: http://www.huawei.com/minisite/gci/en/index.html). Accordingly, digitization is an existential tool for active and engaged ESG management. Without digitization as a tool to measure sustainability data of a property and its users, it is impossible to understand, manage and optimize sustainability performance in a real estate portfolio. As outlined in previous blog posts, ESG management is an interdisciplinary, cross-cutting task that touches all areas of real estate value creation and lifecycle. This impact on all areas and actors of real estate management is visualized in the graphic on the right. The resulting structural design of ESG data management, applied to a property, is shown in the left-hand diagram. This systematic structure enables the measurement of the sustainability performance of real estate, including user behavior, and the development of corresponding optimization strategies and measures.

Current challenges for efficient digital ESG management

In practice, more and more sophisticated digitization strategies for real estate are currently being developed. These digitization strategies increasingly include the use of platforms, data analytics, smart building use cases, etc. However, these digitization concepts only work if the buildings are also operated "smartly" and the generated data is available in a high quality and structured form. One exemplary and currently popular use case among investors in this context is smart metering concepts that are implemented so that owners and investors obtain transparency with regard to the media consumption of real estate.

However, the measurement and higher-level evaluation of data points alone do not by any means lead to significant added value for an owner, operator or user. The mere visualization of data creates data transparency and supports the viewer in evaluating this data, especially for reporting purposes. But only if the owner would be specifically shown with which optimization measures and solutions the consumption can be continuously reduced, the owner experiences an added value. The vast majority of IoT systems, however, lack this functionality to regulate themselves and automatically carry out optimization measures or suggest them to the user. But it is precisely such integral higher-level intelligence that would make ESG management valuable.

In the case of new leases, topics such as data protection and data usage regulations can be regulated in so-called green lease agreements. This is often a problem in the existing portfolio.

Another challenge is that ESG management is structurally integrated into core processes in companies only to a limited extent. In some cases, ESG management is insufficiently integrated into the organization in practice, so that the implementation of targeted ESG measures in the core processes of the corporate organization is only partially successful. The lack of a role model, decision-making powers and competencies makes it difficult to manage sustainability issues (data-based). Ideally, an organization should clarify at an early stage what requirements ESG management has for the functionalities and technical equipment of buildings. If these factors, such as ensuring the integral connectivity of sensors, measuring points and technical equipment and communication with a data platform, are integrated in good time into the planning and design of intelligent building operation concepts, data-based ESG management will then be possible in regular operation.

The use of sensor technology, measuring points, meter concepts, etc. have a high impact on the building concepts, which should be integrated at an early stage in the planning. This ensures that the future property has all the necessary functions so that active ESG management can be operated. Furthermore, BIM planning has extensive possibilities to determine sustainability optimization potential already in the project planning phase. Companies, such as co-builders, analyze the sustainability of projects based on the BIM data. This data can also be used for extensive sustainability simulations, allowing the owner / investor to make informed decisions in the planning process that increase the sustainability of real estate. Retrofitting buildings with measurement points and IoT devices to support sustainability measurement is costly and tends to always involve qualitative compromises.

How does data from regular operation reach the ESG managers?

As shown in the figure above, it is only possible to measure ESG factors from the regular operation of a building through a comprehensively intelligently planned infrastructure in the buildings. This allows the ESG manager extensive control & evaluation capabilities. Of course, the measuring points are to be integrated into an overall concept of connectivity so that all measuring points in the building concept can be read out efficiently and these communicate with the ESG manager. This applies not only to the building technology-related measuring points (such as energy consumption, water consumption) but also to other intelligent devices (IoT devices) that provide additional information on building operation. These devices often aggregate a wide variety of conditions and information regarding user behavior, such as the occupancy of spaces, waste behavior, and heating & cooling demand based on the occupancy of the premises. All of this information is ideally mapped into one or more platforms so that an ESG manager has an overview of all of a property's sustainability data. These platforms combine the current live data of all deployed devices in the building,with specific environmental data (e.g. weather data, mobility, event data). As soon as the structured data availability of all sustainability data of a property is ensured in a central database, intelligent applications can access, evaluate and use this data basis. It is precisely such intelligent applications that generate added value for ESG management, enabling specific issues to be examined and optimization measures to be initiated if necessary. By combining the various data from all devices at a superordinate level and providing corresponding, integral access to all data from all systems, it is then possible to offer interdisciplinary services to the users/owners, which intelligently network the individual applications with each other and allow automation. Thus, the possibility is created to operate self-regulating systems that continuously and automatically optimize the sustainability factors of real estate by means of live data. Manuela Stucki, Senior Digital Real Estate Manager at Swiss Life Asset Management AG, classifies the role of digitalization for ESG management as follows:

- What role does digitalization play in ESG management?

Digitization plays a very important role in ESG reporting. This is because data, such as consumption or investment information, is essential for targeted ESG management. - What added value does digitization bring to ESG management?

Digitization ensures that the right data is available in the required quality, enabling tenant awareness, energy controlling and monitoring, and ongoing operational and strategic optimization measures. In addition, intelligent systems on the property (such as load management, presence-based lighting, sun position-guided shading, etc.) support the achievement of corporate goals all around ESG. - What are the limits of digitization in ESG management?

There are various factors, such as well-being or satisfaction, which cannot be measured with sensors. In addition, a person is still needed who can interpret the data correctly and derive and implement effective measures.

Process understanding potentiates ESG optimization

But who are the people who actually compile the data, evaluate it and make it available in a binding manner? The trend is toward ESG managers who have the technical expertise and at the same time hold the digital threads to the stakeholders involved in their hands. It remains to be seen whether this will lead to the establishment of a new "ESG as a service" model. In the future, it will be essential for owners to attach the greatest importance to the primary storage of data in order to be able to provide information throughout the entire real estate life cycle. Consistent data storage in the face of changing service providers or changes in ownership is a basic prerequisite for efficient ESG management.

In addition to IoT and other measurement data, which is usually consolidated and imported into the corresponding ESG data environment via interfaces, targeted ESG management also requires data from processes that arise during real estate operations. FM service providers, property managers and other stakeholders currently have and "collect" valuable data, consciously or unconsciously. For example, waste disposal and operating resources used by service providers are usable data that must be made available to the ESG manager in the future. These processes can be digitally organized via CAFM solutions, which should be operated on the owner side and made available to the service providers, and their data can in turn be consolidated and transferred to an ESG platform.

In this sense, Justus Wiedemann, founder and CEO of the ESG optimization platform Quantrefy, also pleads for a better understanding of the processes at all operational levels:

"What digital tools in the ESG area have long since comprehensively mapped are data and digital building clones. But what they still focus on far too little is the human being - especially the operational staff in AM, PM, FM, etc., i.e., those who stand as gatekeepers between a large treasure trove of data and genuine ESG optimization on the property. ESG still means one thing above all: more work. More data? More work. More benchmarking? More work. New digital tools? Still too often, more work as well. That's why, in addition to data models, digital solutions must finally understand processes at the operational level - and actively simplify them instead of complicating them further. Then ESG will finally become a simpler and more rewarding path there as well. And thus also implemented across the board."

How will ESG-compliant data management of the future take place?

Due to the current developments in digitalization, all investors and owners are aware that the potential lies in the use of real estate data in the future. Continuously, technologies are evolving and enabling intelligent use of data and application of devices that do not exist today. The common feature of future data-based applications, however, is that they rely on a sound and intelligent data basis in order to develop their potential. This means that structured data management should already be in place today in order to be able to use it with future applications. For this reason, the first investors already have so-called "data lakes" and "data hubs" in which the real estate data is stored centrally and future applications can access these data vessels. In this context, the question arises as to how such a data receptacle should be designed. Is the strategically intelligent solution a single, comprehensive platform for mapping all data in a central location, or are intelligently networked isolated solutions that are interoperable more future-proof?

Experience shows that extensive platforms have little flexibility with regard to interfaces and further developments due to the generically designed structures, since a certain basic structure exists. In the case of stand-alone solutions that clearly focus on specific applications and cover them with a high level of quality, connectivity with other stand-alone solutions is challenging because data must be exchanged, highly aggregated and archived. This often leads to complex system landscapes with which an owner / investor does not want to deal in detail.

Digitization connects users with the property

Digitization can also positively influence user behavior. If we recall the introduction of the Heating Cost Ordinance in 1981 due to the oil crisis in the 1970s, it was already clear at that time that transparency and the consumption-based billing of heating costs had triggered a rethink among people in the use of heating energy.

With today's technical possibilities of a smart building, where even individual users can be "reached" via their smartphone, the levers for saving energy have become much greater. Perhaps opening a window at a certain time makes more sense than turning on the air conditioning? With a message to the person in the room, sustainable usage behavior can be achieved here without much effort. A combination of personal (anticipatory) usage behavior (e.g., appointment calendar, booking of rooms) and individual well-being criteria with the technical possibilities of the property also have a positive effect on ESG criteria through clever networking and provision of services. After all, it is not only one's own carbon footprint that is improved through more conscious usage behavior by uniting people and real estate with the help of digital aids. It also brings us a step closer to achieving our climate targets.

Hansjörg Sidler; Siemens Sales Director Switzerland Energy Efficiency, summed it up as a speaker at the last "120'@8" event of our Swiss Alpha IC colleagues in May: "A perfect place is when buildings become more sustainable thanks to digitalization." That should be our common goal.

Future posts in the blog series: ESG in Real Estate Practice.

Part 6: Meaningful rating versus "greenwashing"

Part 7: Roadmap for a new corporate culture

Part 8: Whitepaper: ESG in Real Estate Practice: 10 Tips for an Effective ESG Transformation

If you would like to read the previous parts of the series, please feel free to click on the respective link:

- Part: ESG in Real Estate Practice. Status quo of a transformation process

- Part: ESG in Real Estate Practice. Perspectives and needs of the stakeholders

- Part: ESG in Real Estate Practice. Challenges for development

- Part: ESG in Real Estate Practice. TDD and ESG DD Your contacts in matters of digitalization at Alpha IC:

Sebastian Hein, Partner und Senior Project Manager, Alpha IC

Tel. +49 151 422 294 - 40 ∙ s.hein@alpha-ic.com

- Digitalisierung/Smart Building

- Facility Management

Lukas von Rotz, Partner, Alpha IC Schweiz AG

Tel. +41 (44) 533 81 71 ∙ l.vonrotz@alpha-ic.ch

- Digitalisierung/Smart Building

- Facility Management